Similarly, a company facing economic headwinds might show declining figures, but a closer look could reveal that it is outperforming its peers under the same conditions. If we take historical data of the financial statements of a company for year 1 and year 2, then one can compare each item and how it has changed year-over-year. Horizontal analysis allows for the comparison of financial data over time, highlighting trends, patterns, and changes in performance. It helps identify growth or decline areas, assess strategies’ effectiveness, and make informed decisions.

- Another advantage is that horizontal analysis emphasises outliers and unusual fluctuations.

- Comparative income statements with vertical analysis can be compared to give a company an idea of its financial health spanning years.

- However, the percentage increase in sales was greater than the percentage increase in the cost of sales.

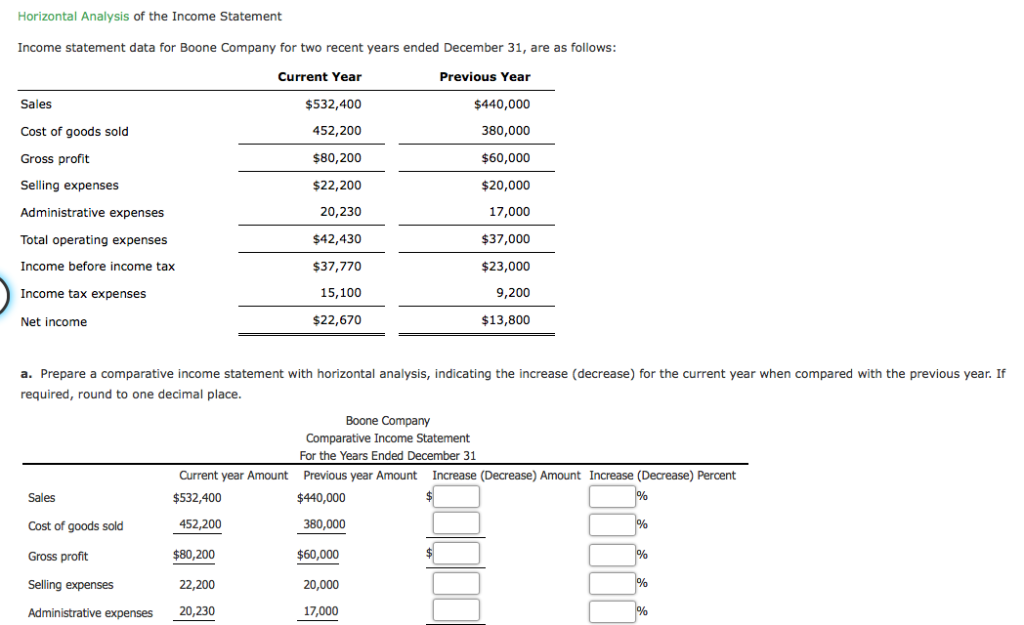

- We need to perform a horizontal analysis of the income statement of this company.

Data Tables

Here net income has decreased by $2,750 or 12% in year 3 when compared to year 1. In fact, there must be a bare minimum of at least data from two accounting periods for horizontal analysis to even be plausible. A fundamental part of financial statement analysis is comparing a company’s results to its performance in the past and to the average industry benchmark set by comparable peers in the same (or adjacent) industry. Horizontal analysis is valuable because analysts assess past performance along with the company’s current financial position or growth.

Step 4: Analyzing the Results

You can see every important item from the retained earnings from the previous year to the net income, dividends, and the retained earnings by the end of the year. Both years are compared with each other and it can be seen generally that there has been a significant increase in earning from all sources. The final step involves you reviewing these changes and making appropriate use of the information you get from your analysis. It is where you determine your company’s growth and trend in your financial health.

Horizontal Analysis using Income Statements

Obviously financial statements for at least two accounting periods are required, however, using a larger number of accounting periods can make it easier to identify trends within the financial data. Just like horizontal analysis, vertical analysis shows useful information and insights about the health of your finances. Vertical analysis is conducted on financial statements over multiple periods and can be used to identify ratio changes. By analyzing financial statements, your company accurately spots trends over time and identifies the mix of assets and liabilities it has to deal with within a certain period. Financial analysis helps you examine relationships between different financial items and determine efficient operations to manage them.

For example, if a company’s revenue growth is lagging behind industry averages, it might indicate a need for strategic changes. Similarly, if a company’s operating expenses are higher than those of its competitors, it might highlight areas where efficiency improvements are needed. This comparative approach helps companies stay competitive and align their strategies with industry best practices. External factors such as economic conditions, industry trends, and competitive dynamics can significantly influence a company’s financial performance. For example, a rise in revenue might be attributed to favorable market conditions rather than internal improvements. Conversely, a decline in net income could be due to external economic downturns rather than operational inefficiencies.

Financial Accounting

An income statement tallies income and expenses; a balance sheet, on the other hand, records assets, liabilities, and equity. A third limitation is that horizontal analysis exclusively examines past performance in retrospect. Although it is beneficial for monitoring historical trends, it does not offer any predictions regarding future outcomes. Horizontal analysis does not include forward-looking data, such as budgets, forecasts, and leading indicators, which would offer a predictive perspective. Another limitation is that even minor absolute changes sometimes manifest as significant percentage adjustments in accounts with initially low balances. An expense category that commences at Rs. 1,000 and increases to Rs. 2,000 represents a 100% increase, but only a Rs. 1,000 variance in actual rupees.

For example, if a company’s total assets are $10 million and inventory is $1 million, then the vertical analysis of the balance sheet would show inventory as 10% of total assets. This method is useful for comparing the relative importance of line items in the financial statement. The income statement displays profitability, expenses, and revenue over a specified time frame. Analysts observe trends in critical accounts, including revenue, cost of goods sold, R&D costs, SG&A expenses, operating income, interest expense, and net profit, through horizontal analysis. Success is typically indicated by increasing revenues and net profit, while challenges are indicated by declines.

Trend Analysis is a technique used to identify trends spanning different accounting periods by highlighting the changes in different financial statements when comparing items to each other. For example, if a company’s revenue was $1 million in 2019 and $1.2 million in 2020, then the horizontal analysis would show a 20% increase in revenue. This method is useful for identifying trends and changes in a company’s financial performance. The business assesses performance on an “apples to apples” basis by comparing each period to a base year, even though the absolute numbers fluctuate over time.

Within an income statement, you’ll find all revenue and expense accounts for a set period. Accountants create income statements using trial balances from any two points in time. Through virtual bookkeeping, one can ensure that accessories business owners are well prepared for their taxes. The bookkeeping service with single entry bookkeeping, double entrybookkeeping, or even accrual bookkeeping makes sure that the transactions are efficiently recorded.