For example, on January 1, as a corporation, we issue 10,000 shares of the common stock for $100,000. These 10,000 shares of the common stock have a par value of $1 per share. Alternatively, if the company ABC issues the stock at a price that is higher than the par value, the difference will be recorded as additional paid-in capital. This total par value will be recorded as the common stock under the equity section.

Examples With Journal Entries

So it means they need to record the common stock to treasury stock before retiring the stock. Company ZZZ issues 100,000 shares of $ 1 par value common stock into the market for $ 100 per share. In applying to the state government as part of the initial incorporation process, company officials indicate the maximum number of capital shares they want to be able to issue.

Authorized Share

- This is similar to “shares authorized,” the maximum number of shares a company is allowed to issue.

- However, in this example, ABC and Kevin agree on a price of $18 per share (Kevin was well pleased).

- Although not mentioned directly, Kellogg now has only 382 million shares of common stock outstanding in the hands of the stockholders (419 million issued less 37 million treasury shares).

- Each share of the company’s common stock is sellingfor $25 on the open market on May 1, the date that Duratechpurchases the stock.

First, we need to create the call account, the asset receivable of monies due. And then second, the receipt of those monies from the shareholders. The debit to the bank account reflects the additional cash ABC now has from the share offering. The credit entry to the Class A Share Application reflects the liability the company also holds. And as we’ll see, some people will be getting their money back.

Understanding Goodwill in Balance Sheet – Explained

In exchange for these instruments, the company issues shares, which provide the holder with several rights. The latter source of finance comes from third parties, such as banks and other financial institutions. The debit to the share capital account removes the 100,000 class A shares from ABC’s equity. The $1,400,000 debit to the additional paid-in capital account also reduces ABC’s equity section. And to balance the accounting equation, we see the removal of the treasury stock from the asset side. Accounting for common stock is very critical ranging from the date of issue of common stock to dividend declared and paid.

There are two main sources of capital that the company can use to raise more cash to support operations. Authorized share is the number of quantity in math definition uses and examples video and lesson transcript shares state in the company incorporation of the article. It represents the maximum share that the company able to issue in the future.

What are common shares?

In most cases, companies receive payments through the bank for this process. However, companies may also issue shares in other cases, for example, in exchange for goods or services. Since the company may issue shares at different times and at differing amounts, its credits to the capital stock account are not uniform amounts per share.

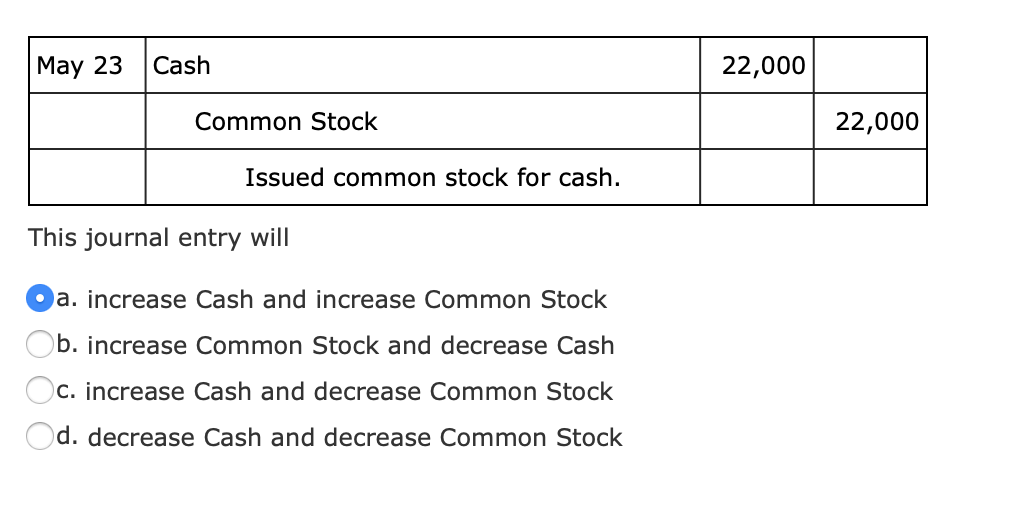

In the above journal entries, the debit side involves the bank account. However, some companies may also issue shares in exchange for other instruments, for example, convertibles or warrants. Similarly, some companies may offer stock to pay suppliers for their products or services. Nonetheless, the credit side will remain the same in most share issues.

The equity attributed to the common stock’s par value will increase by the number of shares issued multiplied by the par value per share. Any remaining proceeds will increase the line item for additional paid-in capital in excess of par value. Likewise, if we issue the common stock at par value there will be no additional paid-in capital in the record. In this case, we can make the journal entry for the issuance of common stock at par value with the debit of the cash account and the credit of the common stock account.